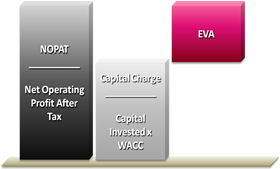

EVA is an estimate of economic profit, which can be determined by making adjustments to GAAP accounting, including subtracting the opportunity cost of capital. EVA is a way to determine the value created, above the required return, for the company shareholders. EVA is Net Operating Profit After Taxes ( NOPAT) less the money cost of capital. The cost of capital refers to the amount of money rather than the % cost of capital. The amortization of goodwill or capitalization of brand advertising and other adjustments turn Economic Profit into EVA.

Mike Ayres had the task of proving that EVA and Net Present Value arithmetically tie under a variety of scenarios, so management could be assured that increasing EVA creates shareholder value.

What he proved was that the Net Present Value of a Business Case was the same as the Market Value Added or NPV of the EVA of the business case.

I rolled out a simpler version of this concept to several small businesses and it highlighted that some of the higher operating margin segments did not provide the highest returns to the business due to their fixed and working capital intensity.

Let me know if I can help you understand your relative economic returns of your business segments.

*G. Bennett Stewart III (1991). The Quest for Value. HarperCollins.

No comments:

Post a Comment