It reminded me of the Dilbert carton by Scott Adams. There were always good cartoons pertaining to what was going on around me or pertaining to concepts I was teaching.

This blog provides business and social media tips for small and medium sized businesses.

Tuesday, August 31, 2010

The Sketchpad: Personal Finance on a Napkin

This is an interesting article I saw in the New York Times Money Section. In a series of back-of-the-napkin drawings and posts on the Bucks blog Carl Richards, has been explaining the basics of money through simple graphs and diagrams. The aggregated series of drawings can be found in this link. If I was still teaching some of my Financial Planning and Analysis classes, this would be a good kick-off to each class (with authors permission of course).

It reminded me of the Dilbert carton by Scott Adams. There were always good cartoons pertaining to what was going on around me or pertaining to concepts I was teaching.

It reminded me of the Dilbert carton by Scott Adams. There were always good cartoons pertaining to what was going on around me or pertaining to concepts I was teaching.

Great Reasons to outsource Payroll

I have come across several small businesses with payroll and IRS issues when they attempted payroll on their own. Even a small business with few employees should consider outsourcing of payroll. While peace of mind may be reason alone for outsourcing payroll, below are additional reasons why outsourcing payroll services may be a great solution for your small business:

- Save time by letting outsourced payroll specialists do the work.

- Generate money by focusing your time on building your business.

- Avoid penalties where errors in federal, state and local taxes and filing requirements may be avoided.

- Reduce costs by comparing in-house processing wages to outsourced processing fees.

- Avoid the hassle of needing to stay on top of payroll rules and regulations.

- Economically Add employee benefits such as direct deposit and 401(k) plan options.

- Avoid payroll processing headaches having to upgrade in-house software.

- Leverage outside expertise on regulations, withholding rates and government forms.

- Eliminate payroll disruption if your payroll person leaves.

- Security, most payroll services firms have technologies that can spot and alert clients to various types of payroll fraud.

- Have all reports and forms filed timely.

- Ability to leverage multiple payment options.

- Small Business Accounting Systems such as Quickbooks have interfaces to major payroll vendors in addition to their own outsourced payroll service. For those utilizing many of Quickbooks features, Intuit's payroll services should be considered.

Saturday, August 28, 2010

Traditional Business Plan - Why it is Not Appropriate For Entrepreneurs

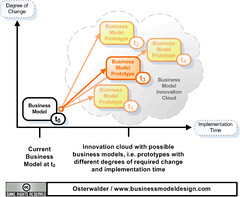

Image by Alex Osterwalder via Flickr

Image by Alex Osterwalder via FlickrIn my Financial Planning and Analysis work, I had the opportunity to review and develop many business plans for both large corporations and for entrepreneurs. A conclusion I have reached is the traditional business plan is not appropriate for entrepreneurs.

When I review my small business consulting work, I have helped entrepreneurs develop four types of business plans depending on where they are in their business life cycle:

- The "Idea" Business Plan: It is a summary where you describe your venture in broad strokes and what will be required to make it happen. The objective is to answer the question to you concerning the feasibility of the idea. And, yes at times I have seen the original genesis on napkins (They were big ones).

- The "Equity Financing" Business Plan: This highly polished 20-35 page document is used to persuade equity partners to invest now. The objective is to sell a potential investor on the value of a ‘show & tell’ meeting with you.

- The "Operating" Business Plan: This plan evolving over time contains the details documenting how to operate your business from launch date to maturity. This Business Model can be used to highlight key processes for improvement.

- The "Bank/Debt Loan" Business Plan: This conservative version of the business plan is used to apply for a loan and focuses on persuading the banker that you can satisfy their lending criteria. Be careful since this plan can be the source of financial covenants you must meet in the loan document.

I did some research given my corporate background since none of these were the traditional corporate business plan that I had developed and taught how to do over the past twenty years. I found from my experiences and research the entrepreneur needed a more flexible planning approach for the following reasons:

1) Mindset: As I observed, entrepreneurs and larger corporations think differently and have different goal structures. Research conducted in 1997 by Saras D. Sarasvathy, Phd of the University of Virginia

- Take a predetermined goal and given a set of means,

- Develop any new means needed to achieve that goal,

- Identify the best cheapest, fastest, most efficient way to achieve that given goal.

Effectual reasoning is opposite of casual reasoning in that it begins with a set of means and allows the goals to emerge over time. It is more of a stepping stone or option approach. A good analogy can be derived from my restaurant consulting experiences. Casual reasoning would be when a client provides the catering chef with a menu and the chef then determines the most effective way to prepare the menu. Casual reasoning would be when a client asks the chef to prepare a menu at the last minute with what he currently has on hand. The chef then looks at all the potential outcomes to make a decision. The latter better reflects the mindset of the entrepreneur while the former reflects the business manager or strategist's in existing enterprises.”

2) How do you research new? Traditional business planning focuses on getting the market research right before you do anything else. How to you research new? Entrepreneurs gain their best market research from actually launching in an Alpha mode and then adapting to the market as it responds to their new venture's offer.

3) Its all going to change! Entrepreneurial research shows successful outcomes have high deviation from their original concepts. The traditional business plan asks us to sit down and plan out the next 3-5 years and describe in detail the sequence of events. Experienced entrepreneurs know that there are just too many variables in resources, market acceptances, timing, product development and the entrepreneur themselves to predict meaningfully in detail the traditional 3-5 year business plan forecast. The entrepreneur will rely on their ability to adapt to the changing environment as it evolves around them.

Thursday, August 26, 2010

Financial Resources For Small Businesses

In several of my engagements, I have helped Entrepreneurs secure financing for their business. Every business needs a certain amount of money to start. The success of a small business depends on the funding it is able to arrange to ensure a smooth cash flow. Different Business Life Cycle Stages will help determine the type of financing available and timing of receiving the financing.

These life cycle stages are:

- Startup: You develop the business model and infrastructure and start early operations.

- Growth: Generally a business has an initial time of negative profit until it breaks even and begins to show increased revenues that allow it to grow.

- Expansion: This is the point at which a business gets to the point where there is sufficient revenue being brought in so that there are no doubts of its survival and it can expand its horizons.

- Mature: The business is now stable enough to survive most unforeseen circumstances. It has enough backing, capital and support to ensure that even if the market becomes unstable, it can pull through.

While many small businesses may choose to get funding in the early stages to start the business, many need access to financial resources even for a running business especially with those that have seasonal patterns. Finding adequate funding for small ventures can be tough and time consuming. Often entrepreneurs end up utilizing their entire savings to keep the business afloat until other financing is available.

These are some of the financing options available:

- Self financing

- Bank Loan

- Friends and Family Loans

- Cash Advance

- Equipment Financing

- Unsecured Loan

- Accounts Receivable Factoring

- Line of Credit

- Home Equity Lines

- Credit Cards

- Inventory Loan

- Vendor Financing

- Working Capital Loan

- Franchise Loan

- Grants

- Equity Investment

Several of these options are more appropriate and easier to secure in the later life cycle stages. Small business financing come at a price and also increase the element of risk involved. However, financing becomes necessary to ensure cash flow, purchase assets like property, expansion of business, equipment or inventory purchase, or simply to have adequate working capital. Utilizing financing makes sense versus using up all of your personal assets and resources. But getting a small business financing approved requires that the owner/borrower is able to provide the following:

- A sound business plan

- Personal profile with qualifications and experience

- Personal financial status statement

- Credit rating of the business if already in operation, or credit history

- Track record of taxes paid in previous years

- Collateral that can be used to secure the loan

Subsequent Blogs will expand on each of these options and points.

Related articles by Zemanta

- Search for credit can take small firms to costly places (seattletimes.nwsource.com)

- How to Finance a Growing Business (online.wsj.com)

- NFIB's Monitoring of the Credit Markets (kauffman.org)

Moving from Off Line to On Line

Image by gullevek via Flickr

Image by gullevek via FlickrOne of the things I enjoy in working with clients on the financial performance of their business, is branching out into different areas of their operations such as marketing. A cost effective marketing tool for some business segments is a Quick Response Code. A Quick Response (QR) code is a two-dimensional code that can be scanned by smartphone cameras to pull up text, photos, videos, music and URLs. These codes have become mobile-friendly ways to point people in the offline media space to online resources. The online resource can be frequently updated.

I have seen a few cost effective ways that you can use QR codes to liven up your entrepreneurial marketing strategies.

- On business cards: A fast and simple way to use QR codes for your own professional purposes is to place them on business cards. Generate a barcode that directs scanners to your online resume, small business Facebook Page, LinkedIn Profile, or your website to help new contacts find you or your business faster and to learn more about you.

- On marketing materials: You likely have brochures, programs, handouts, whitepapers and other materials in your marketing media kit. Add QR codes to direct readers to a particular how-to video, send them to an oline photo gallery, to follow you on Twitter, or point them to a mobile-friendly landing page that promotes a new campaign or a current promotion. You can use the codes for quick changing promotions. For example, my restaurant clients can use this for daily specials to help manage their inventory levels.

- In storefront windows: Google is sending out QR code window decals to top local businesses with Google Place Pages and Facebook Places will likely follow. If they don’t send you one, you can generate your own QR code to place in your window. You can use this code to encourage Foursquare checkins or simply invite customers to share memories on your Facebook Fan Page.

When you are marketing this feature you will want to keep in mind that QR codes and smartphone applications are still foreign to many people even if they have smart phones. More and more people are starting to associate the codes with action, but never assume your customers will know what to do. Make it a point to explain how to scan the QR code and where they can find applications on their smartphones.

Now, if you don't know how to generate a QR code, Mashable/Mobile has a very effective guide on How to create and deploy your own QR Codes.

How do you see your business using QR codes?

Related articles by Zemanta

- QR Codes Have Become the Newest Wave of Mobile Technology (morevisibility.com)

- QR Codes: A New Way to Shop! (wellconnectedmom.com)

- 8 recent examples of using QR Codes for marketing and/or brand awareness (socialwayne.com)

Friday, August 20, 2010

Business Has Increasing Social Presence with Facebook Places

One way to increase value for your business is to leverage free social media. In my Blog on Small Business Web Presence I list several good easy options. With Facebook's Places announcement this week, we now have another tool. Facebook Places is a reach extension for marketers -- when people check in from a venue, they essentially broadcast their presence to their Facebook network. While Foursquare is known for crowning Mayors and awarding badges from checking in to a physical venue, Facebook Places will likely have a coupon or some other type of award. It could be a place they can offer discounts and marketing messages to people within a particular proximity -- whenever Facebook introduces such a feature and cell phones have location services activated.

Marketers with a physical location can benefit from Facebook Places by taking some basic steps. Business Owners can claim their business's Places Page which will be verified by Facebook. Likely in the same way Google Places verifies its Places. Every time anyone checks in from that location, it's a huge deal and business owners will want to control that presence. About 1.5 million business pages exist on Facebook, and each one can merge that page with their Places page by "claiming it". If you are the official representative of your business, take the following verification steps to claim your Place on Facebook:

- Search for the Place on Facebook you wish to claim as your business. If no Place exists for your business, you can create a new Place.

- Once you locate the Place for your business, click the "Is this your business?" link at the bottom of the Place.

- Complete the step-by-step verification process to claim your Place.

This is the link for the Facebook Blog that discusses this in more detail. There is currently an application available for the IPhone and for other HTML 5 and geolocation phones you can access through touch.facebook.com until those applications are developed.

It will be interesting to see how Google and Facebook battle this one out. Let me know what you think of this service.

It will be interesting to see how Google and Facebook battle this one out. Let me know what you think of this service.

Related articles by Zemanta

- Facebook Launches Places With Support of Foursquare and Gowalla (nytimes.com)

- Check into Facebook Places for Your Business (fathomseo.com)

- Is Facebook Places eyeing Google's advertising pie? (sporkings.com)

- Facebook Places From A User Perspective (darmano.typepad.com)

Thursday, August 12, 2010

RSA Animate - Drive: The surprising truth about what motivates us

This is a very thought provoking video on what motivates us. It makes we want to revisit company reward and compensation systems. The other aspect of this presentation is how it is presented. I found the style very effective and it kept my attention.

Quality Everywhere!

On several of my Virtual CFO engagements, I was asked to look at the effectiveness of key operating processes. I had the chance to roll out quality tools and approaches in a lot of different places ranging from an Amish Fine Furniture Maker to cabinet makers in Washington and Florida.

As part of the Six Sigma quality assessment process, you need to have measures after you defined the process. In a couple of cases we had existing data, but wanted to engage the production team. We created a simple manual tracking chart that was placed on the job floor to measure key process milestones. It was as simple as placing some flip chart paper on a wall with volume lines and dates. The shift supervisor updated it at the end of each shift and added any notes.

It was interesting to note that we saw process output improvements as we started to measure the process without making any process changes. Other than the act of measuring! We saw teams beginning to exhibit "one-upmanship" as they wanted to out perform other shifts. For these businesses, labor and materials were key cost drivers. Besides working faster, we identified some work flow, floor layout, supply chain, and communication issues that improved productivity and reduced waste. Several simple paper tools were used to improve the process. On average, the businesses realized over a 20% improvement in productivity that made a noticeable improvement in operating margins and cash flow.

Feel free to contact Steve Cassady for more information on improving your processes.

As part of the Six Sigma quality assessment process, you need to have measures after you defined the process. In a couple of cases we had existing data, but wanted to engage the production team. We created a simple manual tracking chart that was placed on the job floor to measure key process milestones. It was as simple as placing some flip chart paper on a wall with volume lines and dates. The shift supervisor updated it at the end of each shift and added any notes.

It was interesting to note that we saw process output improvements as we started to measure the process without making any process changes. Other than the act of measuring! We saw teams beginning to exhibit "one-upmanship" as they wanted to out perform other shifts. For these businesses, labor and materials were key cost drivers. Besides working faster, we identified some work flow, floor layout, supply chain, and communication issues that improved productivity and reduced waste. Several simple paper tools were used to improve the process. On average, the businesses realized over a 20% improvement in productivity that made a noticeable improvement in operating margins and cash flow.

Feel free to contact Steve Cassady for more information on improving your processes.

Related articles by Zemanta

- Six Sigma Overview (business-project-management.suite101.com)

- DMADV Steps (brighthub.com)

Saturday, August 7, 2010

Shocking Facts You Did Not Know (at least I didn't)

Interesting video that Kris Porter highlighted. This highlights how much and how quickly things are changing. Imagine how much will change over the next 10 years! Business is always changing. Entrepreneurs have a lot of technology changes to factor into their business plans over the next several years. This impacts marketing, customer service, and operations as well. Technology allows entrepreneurs to better position yourself and to display your expertise in solving customers problems.

Related articles by Zemanta

- Know Me, and Like Me and perhaps Follow Me if I deserve it [Penny Power] (ecademy.com)

- What McKinsey Missed in Tech Trends (sophisticatedfinance.typepad.com)

- The Absolute, #1 Reason Small Business Owners Should Be Blogging (dmiracle.com)

Thursday, August 5, 2010

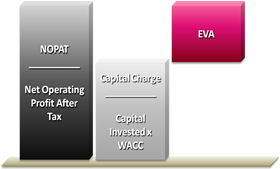

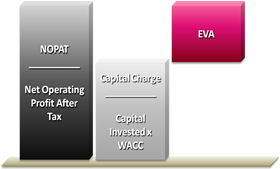

The Real Margin: Economic Value Added (EVA)

I had a "Blast from the Past" question in LinkedIn's Financial Modeling and Analyst Group asking about Economic Value Added or EVA and Weighted Average Cost of Capital or WACC. It triggered memories of many late night brain storm sessions with my Sprint Long Distance Division Operations Analysis manager team of Ben Buttolph, Brad Zerbe, Clark Ward and our Financial Management Develop Program rotation participant Mike Ayres. We actually called our concept Threshold Margins in our Economic Realities Project which became EVA the following year when Sprint Corporate rolled out Stern Stewart's Economic Value Added incentive plan across all Sprint Divisions. The EVA/Threshold Margin concept is key to a Value Based Management approach that we were promoting in our Economic Realities Project. I must admit Stern Stewart did have a better name for the concept! I wish I had read The Quest For Value* before we did the project versus after making our final presentations.

EVA is an estimate of economic profit, which can be determined by making adjustments to GAAP accounting, including subtracting the opportunity cost of capital. EVA is a way to determine the value created, above the required return, for the company shareholders. EVA is Net Operating Profit After Taxes ( NOPAT) less the money cost of capital. The cost of capital refers to the amount of money rather than the % cost of capital. The amortization of goodwill or capitalization of brand advertising and other adjustments turn Economic Profit into EVA.

Mike Ayres had the task of proving that EVA and Net Present Value arithmetically tie under a variety of scenarios, so management could be assured that increasing EVA creates shareholder value.

What he proved was that the Net Present Value of a Business Case was the same as the Market Value Added or NPV of the EVA of the business case.

I rolled out a simpler version of this concept to several small businesses and it highlighted that some of the higher operating margin segments did not provide the highest returns to the business due to their fixed and working capital intensity.

Let me know if I can help you understand your relative economic returns of your business segments.

*G. Bennett Stewart III (1991). The Quest for Value. HarperCollins.

EVA is an estimate of economic profit, which can be determined by making adjustments to GAAP accounting, including subtracting the opportunity cost of capital. EVA is a way to determine the value created, above the required return, for the company shareholders. EVA is Net Operating Profit After Taxes ( NOPAT) less the money cost of capital. The cost of capital refers to the amount of money rather than the % cost of capital. The amortization of goodwill or capitalization of brand advertising and other adjustments turn Economic Profit into EVA.

Mike Ayres had the task of proving that EVA and Net Present Value arithmetically tie under a variety of scenarios, so management could be assured that increasing EVA creates shareholder value.

What he proved was that the Net Present Value of a Business Case was the same as the Market Value Added or NPV of the EVA of the business case.

I rolled out a simpler version of this concept to several small businesses and it highlighted that some of the higher operating margin segments did not provide the highest returns to the business due to their fixed and working capital intensity.

Let me know if I can help you understand your relative economic returns of your business segments.

*G. Bennett Stewart III (1991). The Quest for Value. HarperCollins.

Sunday, August 1, 2010

Small Business Web Presence

Image by adria.richards via Flickr

Image by adria.richards via FlickrIn a couple cases the client was impressed when they received phone calls generated from the free listings before I finished the engagement. Contact me and I can provide you with some simple tools.

Related articles by Zemanta

- 10 Easy Local SEO & Online Marketing Tips (toprankblog.com)

- How Local Search Works in 2010 (smallbusinesssem.com)

- The Big Six: mandatory sites for local bricks-and-mortar businesses (econsultancy.com)

Subscribe to:

Posts (Atom)